Foreign investors in USA can set up subsidiaries under limited liability companies which are also known as U.S. subsidiaries. The incorporation process of a subsidiary has a few formalities and can be entirely explained by our team of company formation representatives in USA. You can also analyze the registration procedure of a company in different states with the help of our general guides to company incorporation.

| Quick Facts | |

|---|---|

| Applicable legislation (home country/foreign country) |

US Company Law |

|

Best used for |

– financial operations, – banking, – insurance, – trading, – automotive |

|

Minimum share capital |

– |

| Time frame for the incorporation (approx.) |

Around 3 months |

| Management (local/foreign) |

Local |

| Legal representative required |

Yes |

| Local bank account |

Yes |

| Independence from the parent company | Yes |

| Liability of the parent company | No, each subsidiary is liable for its debts and obligations |

| Corporate tax rate | 21% |

| Possibility of hiring local staff | Yes |

Table of Contents

Requirements for opening a subsidiary in USA in 2024

Subsidiaries formed under the rules and regulations of an LLC in USA are subject to fast incorporation and must respect the following conditions:

- prepare the Articles of Association with information about the owners, the board of managers, the activities, the registered agent, and the business address;

- create the operating agreement, an internal document that shows the responsibilities of the owners;

- apply for EIN (Employer Identification Number) to pay the taxes in the chosen US state;

- open a bank account for your financial operations (the company’s documents will be needed).

If you want to start a business in USA in 2024 and particularly a subsidiary, it is suggested to talk to one of our company formation agents in USA and ask for support in this sense. We also mention that our team can act on behalf of your subsidiary as a representative agent.

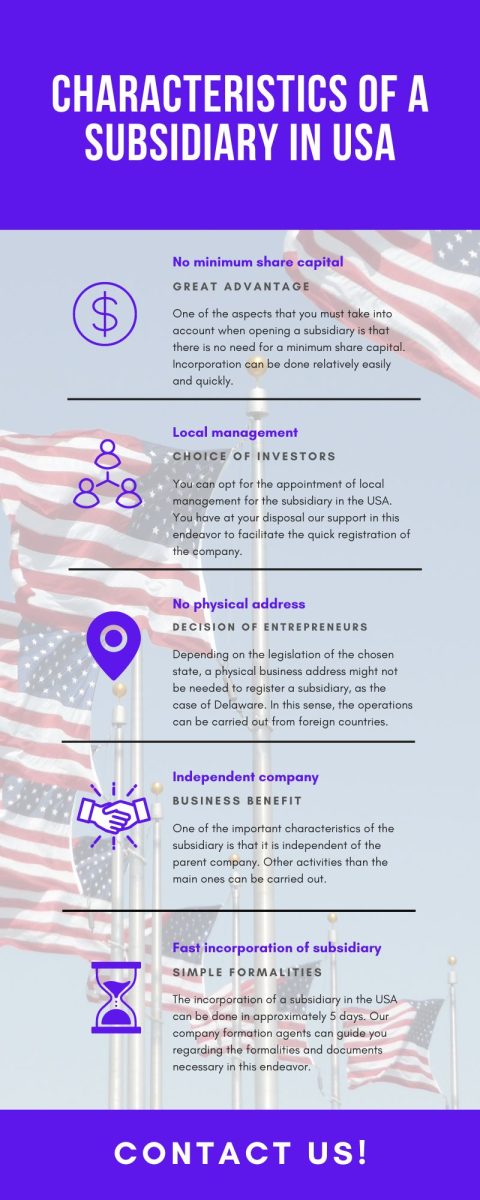

Opening a branch in USA can be an alternative if the subsidiary is not a suitable structure for the businesses you own. The establishment process is quite simple, it can be supervised by our local specialists and it can be ready in a maximum of 5 weeks. We mention that there is no obligation to appoint local management, so you have the freedom to choose workers from your country of origin. Here is an infographic with information on this topic:

Why should I choose Delaware for opening a subsidiary?

Companies from abroad can set up Delaware corporations and perform the activities as subsidiaries. This state is preferred for business due to an excellent tax regime that aims a better environment for foreigners willing to expand their activities on the American market. Such a corporation is not subject to annual stockholders meetings, or transaction approvals made by the board of directors like in the case of an LLC, and reasons why setting up a subsidiary in this particular state is easy. We invite you to find out all the details about opening a subsidiary in 2024 from our agents.

The decision to open a company in USA can be based on multiple options for developing activities of any kind. But in order to benefit from a process without complexities or errors, it is advisable to collaborate with one of our local agents who can take care of the formalities. In addition, they can prepare all the necessary documents, including those required to obtain a business license.

When opening a subsidiary in the USA, one must note that the laws leading US subsidiaries can vary from one American state to another. Subsidiaries can be established under the rules of LLCs or corporations in the USA. Another critical factor is if the subsidiary is an LLC or a corporation, mentioning that tax ID is needed.

The following video presentation explains the process of registering a subsidiary in USA:

Do I need a physical address for my subsidiary in Delaware?

It is good to know that a subsidiary in Delaware does not need to have a physical business address or a bank account, as it can perform financial operations from overseas. A subsidiary in USA is subject to payroll, bookkeeping, and other accounting matters and can act independently from the parent company. More about US subsidiary can be discussed with one of our representative agents in USA.

If you want to start a company in Delaware, we advise you to collaborate with our team of local agents. Incorporation will thus be simpler and faster, requiring only one shareholder and 1 USD as minimum share capital. The shareholder doesn’t need to live in this state, but a representative agent is needed. Moreover, the best use for such a company is doing business outside the USA. Contact us to benefit from free case evaluation and more.

The corporate tax rate for subsidiaries in the USA is set at 21% rate imposed on the annual income. Company owners can pay taxes cumulatively or separately, according to the tax laws.

Guide for US subsidiary – what you need to know to start the business

The US subsidiary can be set up quite easily if you take into account the rules and legislation in force. Find below a simple guide with which to get an idea of how to set up a US subsidiary, with the mention that our local agents can handle all the formalities:

1. Declaration approving the establishment of a subsidiary in USA – This step belongs to the owners of the company who want to establish a subsidiary in the USA. A resolution containing the decision to establish a subsidiary is signed by the chairman and then registered.

2. Choose the type of business structure for the subsidiary – LLC in USA is usually the right structure for a subsidiary, but a corporation can also be a solution. Our local agent can explain all the formalities involved for both structures.

3. Preparing the documents – Once the decision to set up a subsidiary in USA is signed, the next step is to create the documents, also called Articles of Association or Organization. These must include information about the business address, shareholders, activities, management, and voting rights, among others.

4. Asset transfer is made – As soon as the US subsidiary is established, it is traced to the transfer of assets in order to start the activities. A specialist in the field can tell you exactly what the formalities involved are.

5. Preparation of Operating Agreement – This type of document is also called an Indemnification Agreement, it is internal and contains the rules and procedures by which the US subsidiary will operate. Any change of operations in the company will be made only with the consent of the parent company.

6. Application for EIN – This identification code shows that the US subsidiary is registered for payment of fees. Here you can be helped by one of our local EIN registration agents.

7. Open a bank account – This will be used for the financial operations of the subsidiary in the USA. It can be chosen depending on the banking services offered.

8. The board of managers is established – The parent company can appoint the directors of the US subsidiary. They will be directly responsible for the activities and actions of the subsidiary and will establish permanent communication.

9. Outsourced accounting services – It is advisable to hire the services of such a company instead of an entire accounting department. You will have the guarantee that the subsidiary’s accounting complies with local and international standards and rules.

10. Preparation of the general annual meeting – It can be established from the beginning when the general meeting of the company’s shareholders and the US subsidiary, respectively.

Therefore, the establishment of a US subsidiary is not difficult, but attention is needed in terms of the formalities imposed, as well as the legislation that allows this type of structure. We remind you that our company formation agents in the USA are with you with specialized help for setting up a subsidiary in the USA.

21% is the nominal corporate tax for subsidiaries established in USA, which represents an advantage for foreign investors who choose this business structure in the branch exchange.

Organizing business operations for the US subsidiary

US subsidiary can activate on the market as soon as business regulations and legal framework are developed. Company executives must ensure that established and signed rules are properly implemented in the US subsidiary. As this structure is independent of the parent company, it must be organized according to the rules in order to have control over the operations. We invite you to discuss with our local agents everything involved in setting up a US subsidiary.

As such, immediately after registering a subsidiary in the USA, its owners must consider a set of rules that define the business direction and operations. Bylaws provide a context in which various decisions can be made in the company. Here are other aspects to take into account when you want to organize a subsidiary in USA properly:

- It is necessary to appoint a board of directors in charge of the business operations of the subsidiary in the USA. The parent company can appoint such a board to hold a certain level of control in the subsidiary.

- The internal rules are necessary for the business direction of the company. Typically, they are established at the time of the establishment of the subsidiary in USA or even before. Those responsible for decisions in the company will be mentioned, depending on the position they have in the subsidiary.

The aspects mentioned above can be explained in detail by one of our company formation agents in USA. Also, our specialists can manage the formalities of establishing a subsidiary in USA, so you can rely on our support.

Opening a corporate bank account for a subsidiary in USA

The financial operations of a subsidiary cannot begin until a corporate bank account is opened in USA. There are a number of formalities that must be respected, and among them, we mention:

- Presentation of the Articles of Organization of a subsidiary in USA, as well as the Certificate of Incorporation to demonstrate that it is correctly and legally registered.

- Some banks ask for information about the business address in the area where they are located, respectively in the American state chosen for this type of business.

- An EIN confirmation letter will also be presented for tax reporting reasons.

- If one of the company directors is in charge of opening the bank account, identity documents and proof of personal address will be requested.

Opening a corporate bank account in USA is not difficult, but it is recommended to have specialized advice in this endeavor. You will thus ensure that the formalities of the chosen bank are respected and that there will be no rejections in terms of documents. Talk to one of our local agents for support and representation in this endeavor.

Is an operating agreement necessary for a US subsidiary?

Even if there is no obligation in this sense, an Operating Agreement is recommended for opening a business, including for a subsidiary in USA. This document is also known as the Indemnification Agreement, and it is created strictly for internal purposes. Practically, all the procedures and rules for the operations and activities of a subsidiary in USA can be mentioned in this operating agreement.

An important thing to specify is the fact that this document also stipulates the way in which changes can be made to the board and managers, with the approvals provided by the parent company from the subsidiary’s country of origin.

Benefits of a subsidiary in USA

A subsidiary is an advantageous structure for those interested in business in USA and is different from a branch in certain respects. An important benefit is that the business risks are minimal due to the fact that it is a separate entity and that you do not have to be directly responsible for the financial losses suffered.

Another important aspect concerns the taxation system for a subsidiary in USA. For example, corporate tax is set at 21%. Therefore, if you want to establish a subsidiary in USA, you can consider the benefits mentioned above.

Non-profit organizations which provide charitable events can set up for-profit subsidiaries or stay tax-exempt subsidiaries. As such, a subsidiary still pays the nominal tax and also be able to continue as a tax-free and profit-making venture in the USA.

USA, a major business destination for foreign investors

The United States has the strongest economy in the world today. Closely followed by China and Germany, the US remains a top destination for foreign investors who want to enjoy generous profits in a country where they can operate in any field. The innovation sector is among the most prolific in the country and continues to grow at a very fast pace, with many companies of this kind being protected by the optimal business climate, with an attractive tax system and experienced workforce. Here are some statistics that highlight the US economy:

- The US is strongly supported by foreign investment. In 2020 alone, a total FDI of more than USD 10.8 trillion was recorded.

- Manufacturing is the sector that absorbed the most foreign investment in 2020, around 41% of the total.

- Japan, Canada, Germany, Ireland, the UK, and France are among the largest foreign investors in the United States.

- The USA is the host of the largest companies in the world, which have subsidiaries in the biggest and most representative of the states.

If you want to open a company in USA in 2024, we suggest you contact our team of company incorporation specialists in USA for complete information and assistance.