Foreign residents wanting to open a bank account in the USA must comply with certain formalities imposed by banks. While some allow you to open an online bank account as a non-resident, other banks are stricter and prefer the physical presence of the person interested in these services. Discover in this article what are the steps to follow to open a bank account online in USA, with the mention that our company formation agents in USA can help you with all the necessary formalities and documents.

| Quick Facts | |

|---|---|

| Who can open a bank account in USA |

Both natural persons and companies, local or foreign |

|

Formalities to open a bank account |

– natural persons: employment contract or proof of income for foreigners; – legal persons: company documents, certificate of registration for stockholders |

|

Required documents |

– Articles of Association for corporations in the USA; – valid passport, residence certificate, utility bills for natural persons |

| Types of bank accounts |

– saving accounts, – checking accounts, – money market accounts, – investment accounts, – retirement accounts |

| Debit or credit card issued with a bank account |

Yes, depending of the financial purposes |

| Cash deposit to open a bank account |

Some banks solicit small deposits |

| Fees to open a bank account |

For issuance of a debit or credit card |

| Banking services offered (YES/NO) |

Yes |

| Possibility to open a bank account online (YES/NO) | Yes |

| Possibility to pay the utility bills (YES/NO) | Yes |

| Overseas money transfers accepted (YES/NO) |

Yes |

| Formalities for student bank account |

Proof of courses or letter from College in USA |

| Loans option available (YES/NO) |

Yes |

| Offshore bank accounts (YES/NO) |

Yes |

| We provide support to open a bank account | Yes |

Table of Contents

From what age can you open a bank account in the USA?

If you want to open an online bank account in the USA you must be at least 18 years old and be a resident of this country. The chosen financial institution will ask for information about the social security number, personal ID or valid passport, and even the driver’s license. These are the most important documents that the bank can request when you want to open a bank account in US from abroad, in 2024, or by any other method, to which are added the standard forms. One of the local agents in the USA can help you with all the formalities to open a bank account online in USA. Here is also a video presentation that explains more on this topic:

How to open a bank account online as a non-resident in USA in 2024

Foreign citizens can open a bank account online as a non-resident in USA in 2024 with fairly simple formalities, but not all such institutions offer such a service. However, it is quite simple to benefit from a non-resident bank account in USA. The online platform of the chosen bank must offer simple steps through which a bank account can be opened, and among these we list:

- Filing personal documents such as ID or passport.

- Completing the social security number.

- Information about the type of account you want to open.

- The reason you want to open a bank account in USA. Some might need a bank account for opening a company in USA.

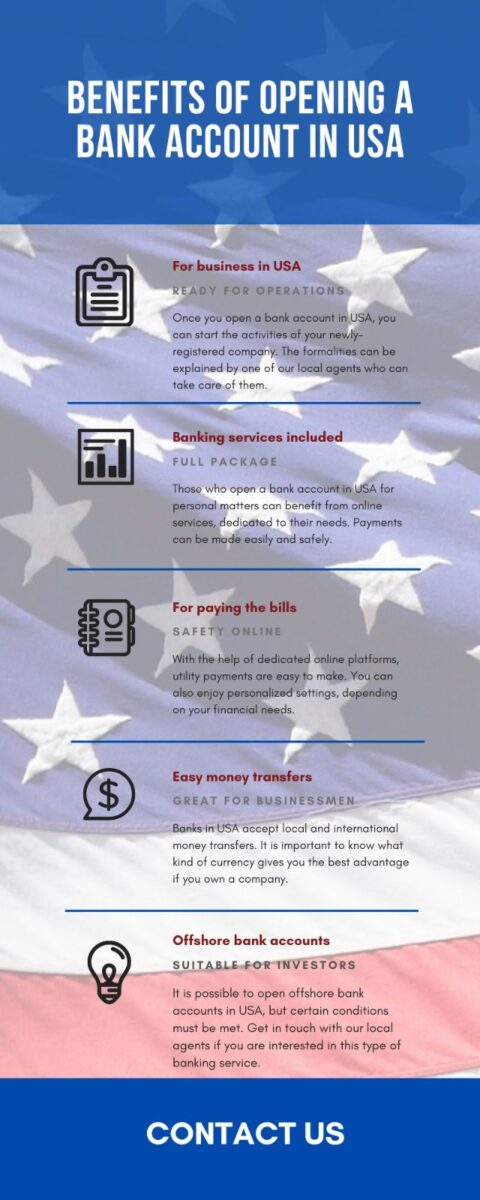

Some financial institutions may also request information about the source of income if the account will be used more for deposits. In addition, those interested in how to open a bank account in US from abroad cannot travel to this country, therefore, it is much easier to make it online. More about how to open an online bank account as a non-resident in USA can be discussed with our agents. We are here to help you start a business in USA and also open a bank account. You can also read the infographic below:

Is a minimum deposit required to open a bank account in the US?

Normally, banks may require a minimum deposit of USD 25 to activate the account, if the documents are accepted. However, there are banks that do not require a minimum deposit but their requirements must be analyzed before opening a bank account in US from abroad. Moreover, you can choose the services of our local agents who can also provide support for those interested in how to open a US bank account from Canada.

Have you decided to open a company in USA? We advise you to collaborate with one of our local specialists who have experience in establishing companies of any kind. In addition to preparing the necessary documents, such as the Articles of Association, they can also take care of registering the company for the payment of taxes. Therefore, there are a number of services that you will need in this endeavor.

In certain cases, when a person does not have a social security number, he can open a bank account using the ITIN or Individual Taxpayer Identification Number issued by the IRS.

The use of a bank account in USA – Main facilities and benefits

Opening a bank account in USA comes with a variety of facilities. Thus, the account opened at one of the banks registered in USA can be used for:

- Salary delivery to the account you use for daily financial transactions.

- Payment of utilities to the accounts of the contracted companies.

- Local and international transfers, in various currencies, approved by the bank.

- Checking the balance as well as access to the transactions made by the customer.

- Obtaining a loan taking into account the fact that the respective client already uses the services offered by the bank.

Therefore, opening a bank account in USA comes with facilities at hand, including for foreigners with residence in one of the American states. If you are interested in more about the process of opening a bank account in USA, do not hesitate to contact one of our local specialists. They can also manage the paperwork involved in the process.

What documents can be used to prove the address in USA

One of the conditions for opening a bank account in USA is the presentation of documents certifying residence. So, in this sense, the bank can request documents such as utility bills, lease contracts, other bank statements, or student enrollment credentials. Each bank is different and can impose its own rules and account opening. Therefore, it is recommended to check these aspects, to know in advance what kind of documents you need in this endeavor. And to simplify things, you can call one of our local agents for support and guidance.

Is a social security number needed for opening a bank account in USA?

There are quite a few banks that ask for SSNs or social security numbers as part of the account opening process. But this is not a mandatory condition. On the other hand, some banks prefer to work with TIN, respectively individual Taxpayer Identification Number or proof of residence. It is advisable to prepare before opening a bank account and even request advice from our company formation agents in USA if you want to open a bank account for the company you own.

Time frame for opening a bank account in USA

Normally, opening a bank account can be done on the same day as presenting the documents, if they are accepted and nothing else is needed. However, there are financial institutions that allocate time to check documents or do more detailed checks, if it is about corporate bank accounts.

On the other hand, even if a bank account can be opened online, it will still be necessary to go to the branch to sign some documents, which does nothing but prolong the process of opening a bank account.

There are varied procedures that must be respected at the time a bank account is opened in the USA. Many banks solicit or make a background check if a large deposit will be made. Most banks will ask new customers for proof of domicile in the USA. But for a better understanding of the bank conditions for 2024, you may talk to our local representatives.

Salary payment into the personal bank account

According to the legislation in USA, it is not mandatory to pay the salary in a bank account. Practically, the salary can be received in cash or with the help of bank checks. However, most companies prefer the delivery of salaries to employees’ accounts, for simplicity, protection, and utility in equal measure. This is how tax declarations can be made at the end of the year, having all the information at hand, with the help of a bank account.

All banks in the USA provide international bank accounts in the local currency, respectively dollars. However, if you are interested in another currency, it is best to ask your bank officer first.

We recommend those who want to start a business in USA talk to one of our local representatives about the formalities involved, including those for opening a corporate bank account.

How to choose the right bank for your needs

Although it may seem difficult to choose a bank to work with in the future, either for personal interest or for the company, things are quite easy. What you need to consider in choosing the financial institution are the types of services offered, the simplicity with which deposits and transfers are made, and the easy use of the online platform offered. In addition, you should consider the fees charged for various services. A tip in this direction would be to analyze each bank offer and find out if the bank has branches in your area of interest.

Those who want to open a US bank account from Canada can contact our specialists. Certain formalities may be different from the usual ones for US residents, so we invite you to talk to us and find out all the details.

Are you thinking of opening a branch in USA? We mention that you can be helped by one of our local representatives, regardless of the American state where you want to develop your business. In addition, you are not obliged to travel to the USA for formalities, you can hire foreign workers, and the entire registration process can take up to 5 weeks.

Certain banks in the USA allow opening accounts online, but it differs from one American state to another. However, if interested in such procedure, it is recommended to talk to a specialist in the field and ask for information in this sense.

Why invest in the US

The United States is the strongest economy in the world, closely followed by countries such as China, Japan, and Germany. Considered the “Land of Opportunities”, the USA is indeed the country where anyone can develop a business, regardless of the chosen field. An experienced, multilingual, and young workforce is one of the strengths offered by the US to foreign investors. Moreover, the business climate is optimal, and the legal system is a transparent one that offers equal rights to those who want to invest in USA, regardless of the country of origin. And to give you an idea of the US economic direction, we present the following statistics:

- Data provided by UNCTAD’s 2022 World Investment Report shows that the FDI flows to the USA were around USD 367 billion in 2021.

- The same report showed that the total FDI inflows for Q2 2022 were around USD 74 billion.

- The USA remains the world’s largest international financial center, and a leading economic power, plus the 3rd-largest country in the world in terms of population.

Investors who want to open a company in Delaware have the opportunity to collaborate with our local specialists. Our local agents can handle the preparation of the necessary documents, the opening of a bank account for future financial activities, as well as the registration for the payment of taxes. A company in this American state comes with a series of benefits, among them, a great tax system and without the obligation for shareholders to live in Delaware. Get in touch with us to find out all the aspects that interest you.

As a primary ID required for opening a bank in USA, most institutions accept US non-immigrant visas and even Canadian citizenship certificates, which facilitates the required formalities.

We invite you to contact us if you want to open an online bank account in USA in 2024. Our agents can also help you open a company in USA.